Our Platform Features

Best way to experience our platform is to book for a demo, but we have tried our best to consolidate our features here, do have a look!

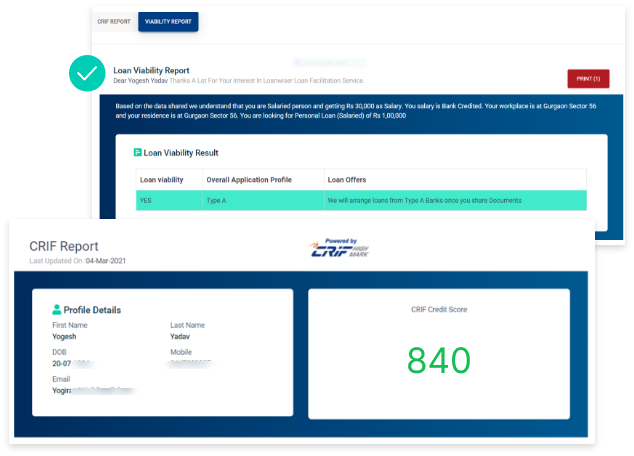

On Spot Viability Check

Get to know whether the loan is doable or not in under 5 mins. You just have to enter basic details of the applicant, system will give perform the initial viability check, even before the lead is submitted.

Instantaneous Credit Assessment

As a part of Viability Check, we will generate Credit Report which helps us understand the past credit history & repayment behaviour of the applicant.

Bank Statement Analysis

We will perform a detailed analysis on the applicant's bank statement which forms a crucial part in estimating the maximum loan amount eligibility for that applicant profile.

Quick And Easy Document Upload

Document requirement for each loan type is listed out in Viability report which can be printed/shared with applicant. Once arranged, these documents can be scanned and uploaded through a super easy upload interface.

In-built Partner Training Modules

We have built a strong knowledge hub - Loan Academy which hosts numerous Training Videos and Documents on System usage, Product knowledge & Best Sales Practices.

Personalized Promotion Materials

Each of your end franchisee will be provided with personalized promo materials & wall -posters (with your logo & their Contact Details dynamically embedded) which can be circulated in their personal Social Networks & WhatsApp.

Document Verification

All documents of the leads can be verified for discrepancies and legibility in an intelligently designed intuitive interface that guides the users to check right information

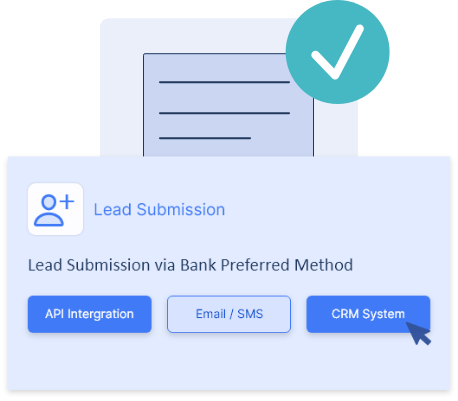

Preferred Modes Of Lead Submission

Leads can be submitted to right financial Institution in your DSA Code via their preferred submission mode:

a. API Integration with lenders

b. Automated Email/ SMS to lender’s team (Lender to provide the contact details of branch team as well as a point of contact in the central team)

c. Data entry into lender’s CRM system

Signup Now for India's Most Intelligent And

Intuitive DSA Business Management Suite